Data Center Lighting Upgrade Financing: A Breakdown of Loans, PACE, EaaS, Rebates, and M&V Protocols

- Why Financing Matters in Data Center Lighting Upgrades

- Equipment Loans & Leasing Options

- Energy-as-a-Service (EaaS) & Lighting-as-a-Service (LaaS)

- PACE & C-PACE Financing

- On-Bill Repayment (OBR) & Utility Rebates

- ESCOs & Energy Savings Performance Contracts (ESPCs)

- Tax Incentives, Depreciation & Lifecycle Cost Planning

- Choosing the Right Mix: How to Decide

- Frequently Asked Questions (FAQ)

Key Takeaways

| Feature or Topic | Summary |

|---|---|

| Why Finance Lighting Upgrades? | To avoid high up-front costs, improve energy efficiency, and reduce OPEX. |

| Main Financing Options | Loans, leases, EaaS/LaaS, PACE, on-bill repayment, ESPCs. |

| Best for Data Centers | Energy-as-a-Service, PACE, utility rebates, and tax incentives. |

| Key Considerations | Payback period, tax impact, ownership structure, off-balance-sheet treatment. |

| Expert Tip | Combine utility rebates with flexible financing for best ROI and rapid deployment. |

1. Why Financing Matters in Data Center Lighting Upgrades

Modern data centers demand efficiency at every level—especially lighting, which impacts power usage effectiveness (PUE), operational clarity, and staff safety. But upgrading outdated systems with high-spec LED solutions, like Squarebeam Elite, isn’t cheap.

- Up-front costs for lighting upgrades can exceed $200k in large centers.

- Deferred maintenance creates risk, but financing enables proactive upgrades.

- Financing lets you implement ROI-positive changes now, without capex hurdles.

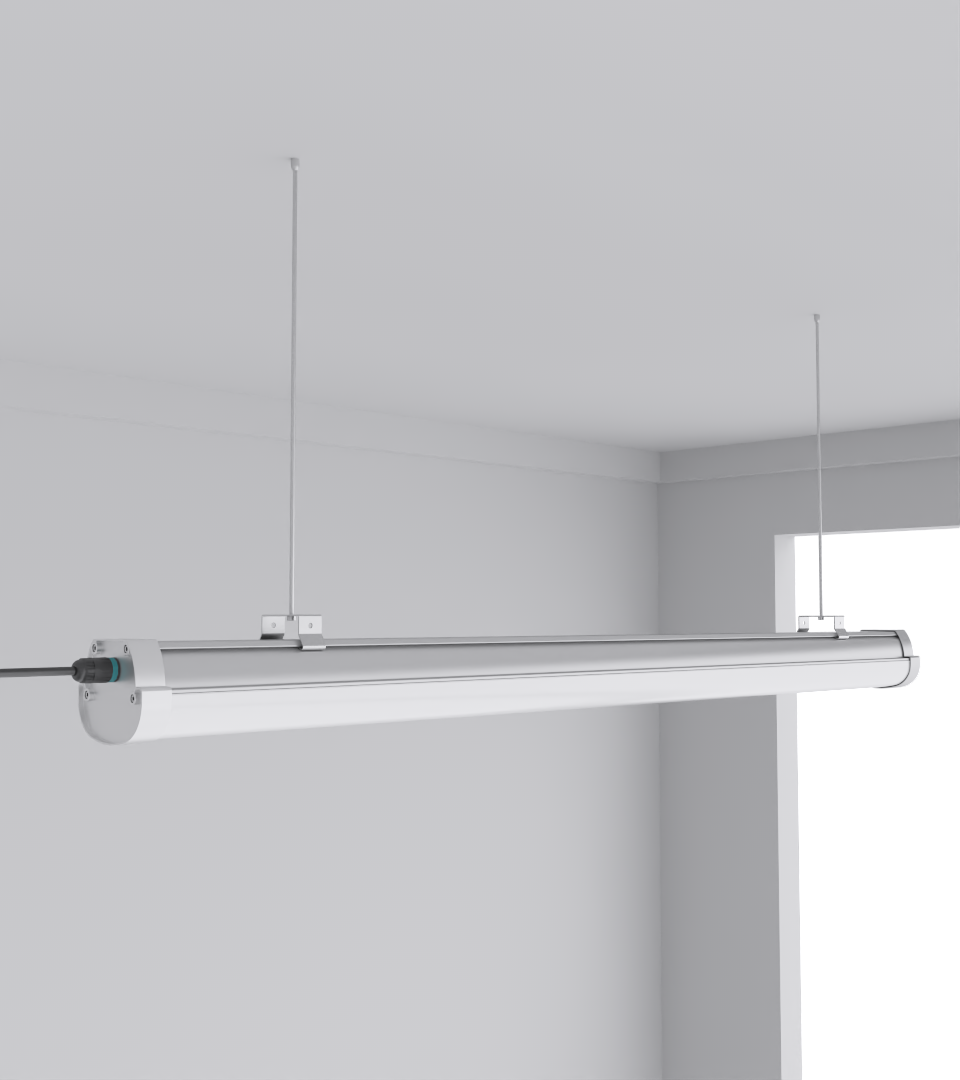

In one Malaysia retrofit, we used the Quattro Triproof Batten in conjunction with motion sensors, cutting energy usage by over 45% with zero up-front cost via utility-tied financing.

2. Equipment Loans & Leasing Options

Loans and leases remain the most common route for data center lighting retrofits.

Equipment Loans

- Fixed monthly payments

- Ownership from day one

- Useful for buyers with strong cash flow

Leasing Options

- Operating Lease: Off-balance-sheet, shorter term

- Capital Lease: Longer term, ends in asset transfer

| Type | Ownership | Tax Benefits | Risk |

|---|---|---|---|

| Loan | Client | Depreciation | Full O&M |

| Lease | Lessor | Deduct payments | Shared |

Expert Insight: Avoid capital leases unless your ROI model requires full control. Leases can be more tax-flexible in certain regions.

3. Energy-as-a-Service (EaaS) & Lighting-as-a-Service (LaaS)

These are subscription-based lighting models. The provider retains asset ownership, handles install, O&M, and upgrades.

- No CapEx: All-inclusive monthly payment

- Off-book: Preserves borrowing capacity

- Guaranteed performance: Often includes uptime guarantees

We implemented EaaS using SeamLine Battens at a warehouse-adjacent data facility. The vendor replaced failed drivers within 48 hours—no maintenance costs on our end.

4. PACE & C-PACE Financing

Property Assessed Clean Energy (PACE) financing allows upgrades to be paid back via property taxes.

- Up to 25-year terms

- Fixed low rates

- Repayment via local tax bill

Tip: Use Squarebeam Elite with a C-PACE structure to bundle lighting with HVAC and controls under one financing stack.

5. On-Bill Repayment (OBR) & Utility Rebates

OBR: Pay via Utility Bill

- Funded by utility or 3rd-party partner

- Repaid as line-item on electricity bill

- Often 0% interest for qualified users

Utility Rebates

- $ per watt or per fixture incentives

- Bonus rebates for control systems

Expert Advice: Always stack rebates with another financing method. Rebates often cover 10–40% of project costs. Don’t leave them on the table.

6. ESCOs & Energy Savings Performance Contracts (ESPCs)

Work with an ESCO (Energy Service Company) to deliver energy savings projects guaranteed via contract.

- ESPCs: Provider fronts capital and is repaid via verified energy savings

- M&V (Measurement & Verification) is critical

Case Example: In a Johor data center, CAE LED luminaires were installed through an ESCO-led ESPC. Energy costs dropped 38% with full M&V validation.

7. Tax Incentives, Depreciation & Lifecycle Cost Planning

Make the most of your investment by claiming depreciation and using federal tax programs:

- MACRS: Accelerated depreciation

- Bonus Depreciation: 100% in year one (subject to phase-out schedule)

Lifecycle Planning:

- Schedule maintenance every 5–7 years

- Budget for driver replacements & module upgrades

- Ensure extended warranties are in writing

8. Choosing the Right Mix: How to Decide

| Facility Type | Best Financing Option |

|---|---|

| Owned, large scale | C-PACE + Rebate |

| Leased facility | EaaS or ESPC |

| Federal/municipal | ESPC + Tax Benefits |

| Cash-rich org | Direct Loan + Bonus Depreciation |

- Do you need asset ownership?

- Are off-balance-sheet options preferred?

- Are utility rebates available in your area?

- Can the provider manage M&V?

Frequently Asked Questions (FAQ)

Q1: What is C-PACE financing and how does it work for data centers?

C-PACE is a long-term, low-rate loan repaid through property taxes. It’s ideal for energy-efficient retrofits like lighting, HVAC, or controls.

Q2: Can I combine rebates and loans?

Yes. Most successful upgrades use rebates as a cash injection while loans or leases cover the remaining project cost.

Q3: Are there tax benefits to financing LED upgrades?

Yes. Through MACRS and bonus depreciation, you can recover a large portion of project cost as tax deductions.

Q4: What happens if the lighting system fails?

If you use EaaS or work with an ESCO, repairs are usually covered under SLA (service-level agreement).

Q5: What is the average payback period?

With rebates + EaaS or leasing, average payback is 3–4 years.

Q6: Who should I contact for a feasibility audit or quote?

Reach out to CAE Lighting Co., Ltd. to discuss product selection and local financing programs.