Global Data Center Trends 2025: AI Power Loads, Cooling Tech & Energy Infrastructure Explained

- Why International Data Center Trends Matter

- AI-Hungry ‘Tech Factories’: Power Demand Surge

- Energy Infrastructure Trends

- Cooling Evolution: From Air to Immersion

- Sustainability & Green Data Centers

- Global Facility Trends & Sovereign Infrastructure

- Edge, Modular & Wireless Innovation

- Expert Observations & Future-Proofing Tips

- Frequently Asked Questions (FAQ)

Key Takeaways

| Insight Area | Summary |

|---|---|

| AI Power Surge | Global data centers are scaling for up to 240kW per rack |

| Cooling Innovation | Immersion and liquid cooling adoption is growing, especially in Asia |

| Green Metrics | PUE near 1.7 is now standard; CUE/WUE becoming key site selection tools |

| Global Growth | Capacity expected to triple by 2030 across APAC, EU, and U.S. |

| Energy Diversification | Mix of renewables, nuclear, and gas underpin future-proof facilities |

| Data Sovereignty | Regional compliance shaping facility location and architecture |

| Edge & Portable Infrastructure | Modular centers and wireless links are reducing latency globally |

| Investment Patterns | $1 trillion+ expected by 2027, heavy APAC and sovereign backing |

1. Why International Data Center Trends Matter

The rise in artificial intelligence workloads and sovereign data laws has pulled data centers from back-end infrastructure into global headlines. You can’t build at yesterday’s pace anymore. Global facility builds now require planners to factor in not only raw compute growth, but also power strain, geopolitical shifts, and cooling strategy in diverse climates.

2. AI-Hungry ‘Tech Factories’: Power Demand Surge

Modern data centers have become compute factories—racks now push 240 kW, up from 20–40 kW just a few years ago. This explosion is driven by GPUs powering large language models and generative AI.

- Chip Trends: NVIDIA’s Blackwell and AMD’s MI400s are breaching 1000W TDPs.

- Rack Design: Density requires redesigned aisles, airflow, and safety tolerances.

- Cooling Response: Many hyperscalers are piloting immersion and cold-plate cooling.

Global Buildout Projections

- 15–22% annual growth expected

- Capacity may triple globally by 2030 (especially in Southeast Asia and Northern Europe)

3. Energy Infrastructure Trends

Power has become the new constraint—not land or fiber. We’re seeing more projects stalled by utility delays than zoning.

- Grid Strain: Metro buildouts face 24–48 month utility provisioning delays.

- Small Modular Reactors (SMRs): U.S., Japan, and France are testing for datacenter baseload.

- Renewables: Projects like YTL’s Malaysian campus integrate on-site solar.

- Gas Bridging: In high-demand markets like Singapore, natural gas stabilizes variable renewables.

4. Cooling Evolution: From Air to Immersion

Traditional cold aisle containment is insufficient at today’s rack loads. Facilities are shifting toward:

- Single-Phase Immersion: Used in GPU-heavy deployments

- Direct-to-Chip Cooling: Preferred in retrofits

- Free-Air Cooling: Still viable in Scandinavian and high-altitude locales

- Water Usage Risks: 40% of global builds now occur in water-stressed regions—design must adapt

Read full guide to data center cooling innovation

5. Sustainability & Green Data Centers

Certifications aren’t just for show—operators are pressured to meet real, public metrics.

- PUE: Power Usage Effectiveness trending toward 1.7 or lower

- CUE: Carbon Usage Effectiveness gaining traction, especially in Europe

- Waste Heat Reuse: Swiss centers now warm community pools; Finland connects to urban heating

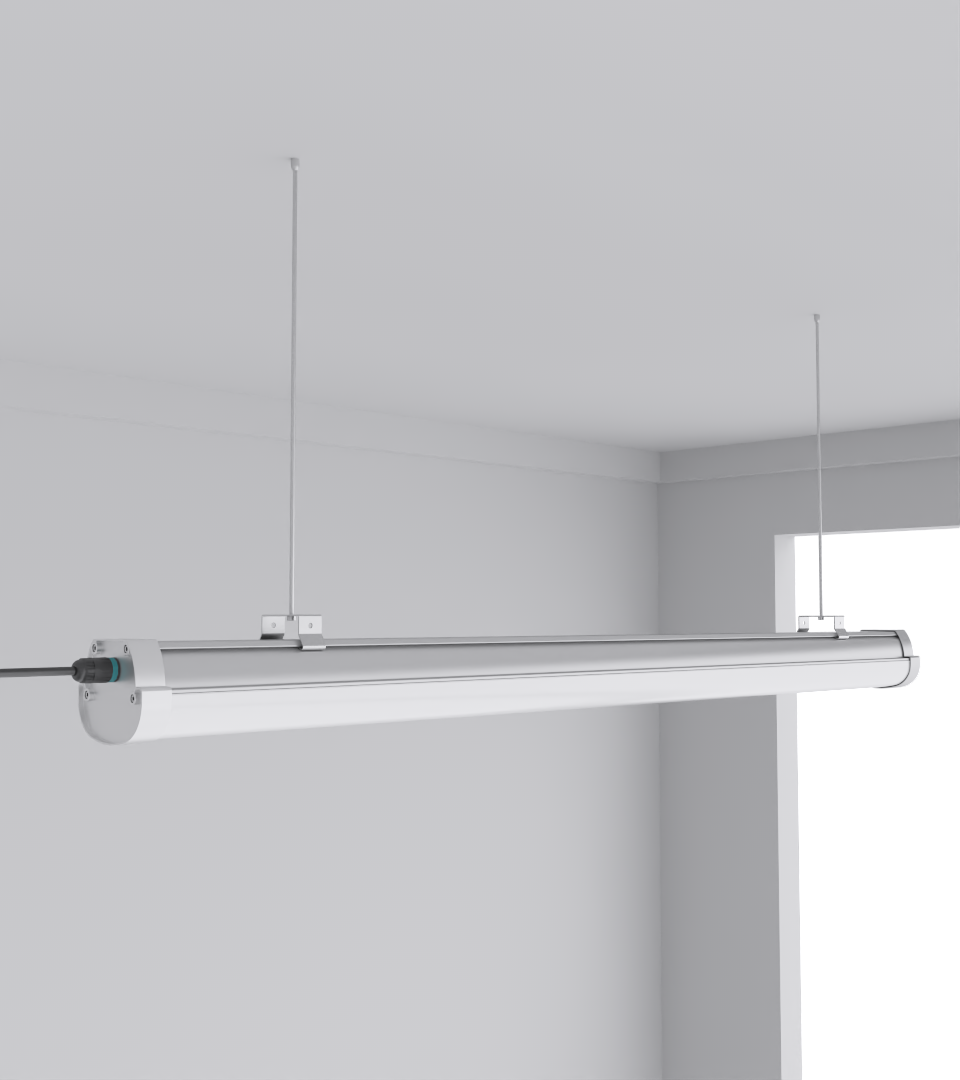

- Lighting Efficiency: CAE’s SeamLine Batten offers high-efficiency, low-glare illumination

6. Global Facility Trends & Sovereign Infrastructure

Regions are now competing to host sovereign compute, often with subsidies and infrastructure guarantees.

- Malaysia: Johor and Sarawak regions driving solar-led builds with support from firms like CAE Lighting

- Australia: Leaning on clean energy and subsea connectivity

- Europe: €20bn investment for sovereign AI capability; heat reuse requirements in Germany and the Nordics

- U.S.: Regulation is tightening, especially in California (SB57, AB222) targeting AI-specific builds

7. Edge, Modular & Wireless Innovation

Global edge demand is decentralizing data center footprints.

- Modular Builds: Containerized deployments for fast rollouts

- Wireless Interlinks: 60GHz links now trialed in Singapore and California

- Lighting Fitment: CAE’s Quattro Triproof Batten ideal for modular and portable spaces

8. Expert Observations & Future-Proofing Tips

From our deployment experience across Asia and the Middle East, here’s what we’ve learned:

- Choose lighting last: Too many facilities waste money relighting due to layout revisions

- Always plan for secondary cooling: Liquid adoption will not be optional by 2027

- Get local buy-in early: Community resistance has delayed 3 major builds in the last 18 months

- Stay ahead of compliance: Especially around data sovereignty and environmental reporting

Contact CAE Lighting for more support or samples

Frequently Asked Questions (FAQ)

What is the impact of AI on data center energy use?

AI workloads are driving rack densities to 200–240 kW, significantly increasing energy demands and shifting cooling and power design priorities.

How does immersion cooling compare to air cooling?

Immersion offers 90–95% heat capture efficiency compared to 40–60% in traditional air-cooled setups. It also enables denser racks.

Why are data centers built near renewables or nukes?

To access stable, scalable, and carbon-conscious power—especially where grid connection is delayed or costly.

What is data sovereignty and why does it matter?

Data sovereignty refers to the legal requirement for data to be stored within a given region. It impacts architecture and facility siting.

How is global data center investment evolving?

Rapidly. Asia-Pacific leads growth, and sovereign funds are investing billions. Expected global capacity: triple by 2030.